- Home

- Buying a home

Mortgage Interest Rate vs APR – What is the difference?

If you’ve ever taken a loan or applied for a credit card, you’ve probably seen the term annual percentage rate or APR. When it comes to mortgages the APR is a percentage, it’s usually right next to the interest rate and looks awfully similar. You might find yourself thinking “what’s the difference between the mortgage […]

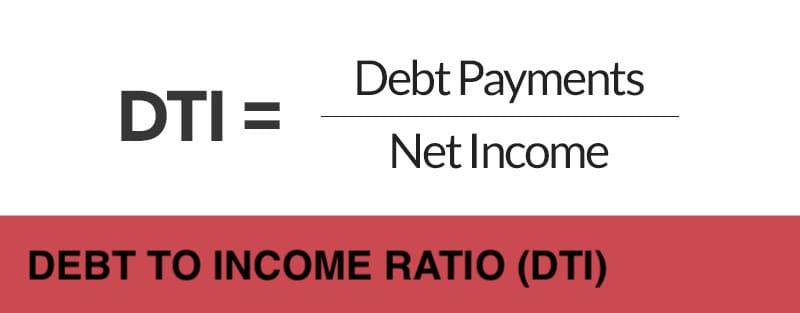

Debt to Income Ratio | Mortgage Process Explained

When underwriting a mortgage, lenders try to understand whether or not you’ll be able to afford your new mortgage payment. They care more about your monthly debt payments than they do your total amount of debt. To understand your ability to repay your debt, lenders will check your debt-to-income ratio. Debt-to-income ratio defined Also known […]

Cash to Close | Mortgage Process Explained

When it comes to saving for a home most people focus on saving for a down payment. While your down payment is a big part of determining your home affordability, it’s not the only component. Between closing costs, fees & taxes you can expect to pay an additional 2-5% of your home price at the […]

Underwriting Your Property | Mortgage Process Explained

The type of property you choose can affect your home affordability, the interest rate you qualify for, and what loan products are available to you as a borrower. Underwriting the property is just as important and underwriting the borrower applying for a home loan. When trying to understand if a property is the right fit […]

Home Appraisal | Mortgage Process Explained

After you give the lender your intent to proceed they’ll order your home appraisal. This is a critical (and potentially frustrating) step in the home buying process. Let’s break down the entire home appraisal process, why it matters for the mortgage lender, and what it means for the home buyer and seller.

How to put an offer on a house

Maybe you fell in love with the first home you saw. Maybe it took you months, but your patience was rewarded with a beautiful house that hit all the sweet spots. However long it took, you’ve now reached the moment of truth – you’re ready to make an offer on a house. You knew this […]

Pre-qualify vs Pre-approval: What’s the difference?

Before you start looking for a home in earnest, though, you should get pre-qualified for a loan. Ideally you’ll get pre-approved. To do that, you’re going to need to talk to a loan officer. What’s the difference between a pre-qualification letter and a pre-approval letter? And how can you find a good mortgage lender or […]

Am I ready to buy a house?

Each homebuyer is different, and the next wave of first time home buyers has the potential to throw the mortgage banks for a loop. With hoardes of freelancers & contractors marching towards self-employment, or companies like Uber, Udemy, and AirBnB offering new, unprecedented ways to make money, income streams are less consistent and more diversified. […]

How does a mortgage work?

If you’re going to have a mortgage, it’s probably a good idea to understand what, exactly, that is. If you learn a little bit about the history of mortgages, not only will you come to appreciate the process, but you’ll look super smart in front of your friends at your housewarming party. What is a […]

Owning a home means staying put for 5 years

Millennials could be missing out on a lot by choosing to rent as opposed to buying homes, according to financial author David Bach. His study found that homeowners are 38% wealthier than renters. Buying a home is more expensive than renting and requires more responsibility; however, unlike renting, when you buy you are making an […]